EXCHANGES & TRADING

Coinbase

Coinbase Exchange Review: The Complete 2026 Guide

Coinbase is a global heavyweight in the cryptocurrency industry, recognized as one of the most secure and reputable exchanges in the world. Since its public listing on the NASDAQ in 2021, it has moved from being a simple Silicon Valley startup to a massive, regulated financial institution. For Australians, Coinbase serves as a high-liquidity gateway that balances a world-class user interface with the accountability of a publicly traded company.

The primary appeal of Coinbase in Australia is its extreme reliability. While many exchanges operate from offshore jurisdictions with limited oversight, Coinbase’s status as a US-listed company means its finances are audited and transparent. This makes it a preferred choice for investors who prioritize “Safety First” and want to avoid the risks associated with smaller, less-regulated platforms. However, users must be aware of the two-tier system: the standard “Simple” interface is convenient but carries higher fees, while Coinbase Advanced provides the professional tools and lower costs that serious traders require.

Coinbase Australia Pty Ltd is fully registered with AUSTRAC, ensuring it meets all local AML/KYC obligations. As Australian regulations evolve in 2026, Coinbase has remained at the forefront of compliance, moving toward the new ASIC licensing requirements for digital asset service providers. This local commitment, paired with global liquidity, ensures that Australians can trade large volumes with minimal “slippage” or price disruption.

Company Background

Coinbase was founded with the goal of creating an open financial system for the world. It has consistently focused on being the “easiest” place to buy crypto, which helped it secure a dominant position in the US before expanding its localized services to Australia in 2021.

- Founded: 2012

- Headquarters: Remote-first (San Francisco, USA origins)

- Regulatory Status: NASDAQ listed (COIN); AUSTRAC registered; compliant with international standards across the UK, Europe, and Singapore.

- Key Milestones: First crypto exchange to go public in the US; launched “Base,” a leading Ethereum Layer 2 network; introduced Coinbase Advanced to replace Coinbase Pro.

- Focus: Security, regulatory compliance, and institutional-grade infrastructure.

Safety and Security

Safety is where Coinbase distinguishes itself from the competition. As a public company, its security practices are under constant scrutiny from both regulators and shareholders.

- Custody: Over 98% of customer assets are stored offline in geographically distributed cold storage.

- Insurance: Coinbase maintains a $255 million insurance policy to protect a portion of digital assets held in its hot wallets.

- 2-Factor Authentication (2FA): Support for SMS, Authenticator apps, and hardware security keys (like YubiKey).

- Audit & Transparency: Quarterly public financial reports and regular security audits.

- NASDAQ Oversight: Unlike private exchanges, Coinbase must maintain strict internal controls to comply with US securities laws.

While the exchange is highly secure, professional investors often prefer to hold their own keys. For a full breakdown of how to move your assets off an exchange, check out our lesson on “Which Cryptocurrency Wallet is Right for You”.

Supported Assets

Coinbase offers a massive catalog of assets, prioritizing projects with high liquidity and legitimate use cases.

- Major Coins: BTC, ETH, SOL, XRP, ADA, DOT

- Altcoins: 240+ supported tokens, including major DeFi and AI projects.

- Stablecoins: Deep support for USDC (which Coinbase co-founded) and USDT.

- Base Ecosystem: Direct integration with assets built on the Base network.

Note: Coinbase is often slower to list new “meme coins” than competitors like CoinSpot, as they put every asset through a rigorous legal and security review process.

Fees and Costs

Coinbase’s fee structure can be confusing for beginners because it varies significantly between the standard app and the “Advanced” interface.

- Simple Trade (Standard): Quoted as a “Spread” + a variable fee (typically 1.5% to 2%). This is the most expensive way to buy.

- Coinbase Advanced: Uses a volume-based maker/taker model. Fees start around 0.40% for makers and 0.60% for takers, dropping significantly as your 30-day trading volume increases.

- AUD Deposits/Withdrawals: Generally free via PayID or Bank Transfer.

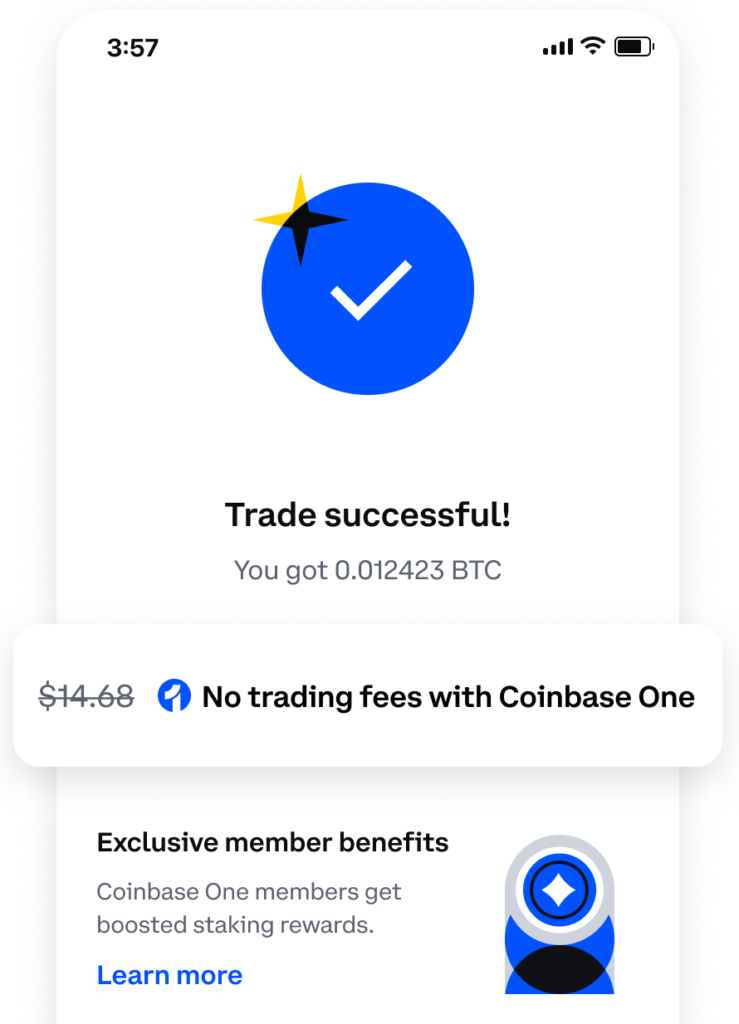

- Coinbase One: A subscription service ($29.99/month) that offers zero trading fees (up to a limit) and boosted staking rewards.

AUD Deposit and Withdrawal Methods

Coinbase has fully localized its banking stack for Australians, offering instant “on-ramps” that rival local competitors.

- Deposit methods: PayID (Instant), Osko, Bank Transfer, Debit Card (High fee).

- Withdrawal methods: Bank Transfer, PayID.

- Deposit times: Instant for PayID; standard bank transfers take 1–2 business days.

- Verification: Your first PayID deposit serves as an additional layer of bank account verification.

Trading Experience

Coinbase offers a seamless transition from a “first-time buyer” to an “active trader” within the same account.

- Beginner Interface: Extremely clean. It feels like using a premium banking app. Best for recurring buys and long-term holding.

- Coinbase Advanced: Built for performance. Includes TradingView charts, real-time order books, and limit/stop-loss orders.

- Mobile App: Features a unified dashboard for trading, staking, and exploring the “Base” ecosystem.

- Liquidity: Because it is a global exchange, you can fill large orders instantly without moving the market price.

Additional Features

- Staking: Earn rewards on assets like ETH, SOL, and ADA. Coinbase handles the technical work and pays out rewards directly to your account.

- Coinbase Learning: Earn small amounts of crypto by watching educational videos about new projects.

- Coinbase Wallet: A separate, self-custody wallet that gives you full control over your private keys.

- Recurring Buys: Easily set up a “Dollar Cost Averaging” (DCA) strategy to buy a set amount of crypto every week or month.

Customer Support

Coinbase has significantly improved its support reputation in recent years, moving away from automated bots to more human interaction.

- Channels: 24/7 Live Chat, Email support, and an extensive Help Center.

- Coinbase One Perk: Subscribers get priority 24/7 phone support.

- Reputation: Known for being professional, though response times can lag during periods of extreme market volatility.

Verification & KYC

Onboarding for Australians is fast and strictly follows AUSTRAC regulations.

- Process: Fully mobile-optimised.

- Documents Needed: Australian Driver’s License or Passport.

- Time: Most users are verified in under 10 minutes.

- Friction Points: If your bank details do not match your ID exactly, there may be manual review delays.

Pro’s & Con’s

Pro’s

✅ Publicly traded (NASDAQ: COIN) for maximum transparency.

✅ World-class security with an unblemished fund-safety record.

✅ Instant AUD deposits via PayID.

✅ Extremely high liquidity for large trades.

✅ Seamless integration with the “Base” DeFi ecosystem.

Con’s

❌ Standard “Simple Trade” fees are among the highest in the market.

❌ Complex fee tiers on the Advanced platform.

❌ Fewer altcoins than “high-volume” exchanges like CoinSpot.

❌ Some advanced features are restricted based on Australian region settings.

Who Coinbase is Best For

- Security-Conscious Investors: Those who want the peace of mind of a publicly listed and audited exchange.

- Intermediate to Advanced Traders: Users who can take advantage of the lower fees on Coinbase Advanced.

- DeFi Enthusiasts: Australians looking to bridge into the Base network or use the Coinbase Wallet.

- Institutional Clients: High-net-worth individuals who require deep liquidity and white-glove custody.

How to Get Started

- Sign Up: Go to Coinbase.com and register your account.

- Verify ID: Upload your Australian ID via the mobile app for the fastest approval.

- Deposit AUD: Use PayID to send funds instantly from your bank.

- Toggle Advanced: If you want lower fees, ensure you switch to the “Advanced” view before buying.

- Secure Your Account: Enable an Authenticator App or Security Key for 2FA.

Final Verdict

In 2026, Coinbase is the premier “institutional-grade” exchange for everyday Australians. It is not the cheapest option if you use the basic “Buy” button, but for those who take the time to use Coinbase Advanced, it offers a level of security, liquidity, and professional tooling that is difficult to beat. If you value the safety of a publicly traded company and want a platform that can grow with you from your first trade to a complex portfolio, Coinbase is a top-tier choice.

Now that you have all the information about whether Coinbase is the right fit for you, it’s time to decide what’s next.