EXCHANGES & TRADING

BTC Markets

BTC Markets Exchange Review: The Complete 2026 Guide

BTC Markets is one of the most established and trusted cryptocurrency exchanges in Australia. Launched in 2013 and built specifically for the Australian market, it has grown into a mature trading platform that blends regulatory compliance, strong security practices, and a straightforward experience for local investors. While many exchanges operating in Australia are global brands adapting their services to local rules, BTC Markets is fundamentally an Australian exchange at its core – designed around Australian banking systems, Australian regulations, and the expectations of Australian investors.

Over more than a decade, BTC Markets has built a reputation for reliability. It has handled millions of trades, supported everyday users through multiple bull and bear markets, and consistently operated within Australia’s financial compliance framework. This long history matters. In an industry where exchanges regularly appear and disappear, BTC Markets stands out as one of the few platforms with genuine longevity, established governance, and a strong track record of protecting user funds.

The platform offers the essential tools most investors need: fast and familiar AUD deposits and withdrawals, a clean interface for buying and selling crypto, and a structured trading environment for those who want more control than a beginner-focused app. It also caters to serious investors through features like volume-based trading fees, OTC services, and dedicated support for Self-Managed Super Funds. This makes it appealing for users who want a platform that sits between a simple “tap to buy” app and a high-complexity global derivatives exchange.

BTC Markets isn’t trying to be everything to everyone. Instead, it focuses on being a dependable, compliant, and easy-to-use exchange for Australians who want a safe on-ramp into crypto without unnecessary complications. If you value stability, local support, and a platform designed from the ground up for Australian conditions, BTC Markets continues to be one of the most credible choices available.

Company Background

BTC Markets has been a fixture of the Melbourne tech scene since the early days of Bitcoin. It has successfully navigated every major market cycle since 2013, maintaining a focus on technical excellence and regulatory transparency.

- Founded: 2013

- Headquarters: Melbourne, Australia

- Regulatory Status: Registered with AUSTRAC; ISO 27001 certified; Gold Certified by Blockchain Australia.

- Key Milestones: Reached over 330,000 users; processed over $25 billion in trades; partnered with FrankieOne for advanced identity verification.

- Focus: Institutional-grade liquidity, SMSF support, and secure AUD/Crypto gateways.

Safety and Security

Security is the primary reason many high-net-worth Australians choose BTC Markets. The platform utilizes a multi-layered defense strategy that prioritizes the offline storage of assets.

- Custody: The vast majority of user funds are held in offline cold storage with multi-signature encryption.

- Insurance: While not a public insurance policy, the exchange maintains a “Security First” reserve and utilizes cold-storage best practices to mitigate risk.

- 2-Factor Authentication (2FA): Mandatory for withdrawals and recommended for all account activities.

- Audit & Transparency: Holds the ISO 27001 certification, which involves rigorous external audits of their information security management systems.

- Past Incidents: BTC Markets has a clean track record with no major fund losses from exchange hacks in its history.

Supported Assets

BTC Markets focuses on quality over quantity. They curate their list to ensure every asset has sufficient liquidity for professional trading.

- Major Coins: BTC, ETH, XRP, LTC, ADA, SOL, DOT

- Altcoins: 35+ high-liquidity tokens, including LINK, UNI, and MATIC.

- Stablecoins: USDT, USDC

- Special Features: Direct AUD trading pairs for all listed assets.

Note: If you are looking for thousands of micro-cap tokens, this is not the platform for you; it is designed for core portfolio building.

Fees and Costs

BTC Markets uses a tiered fee structure that rewards active traders and high-volume accounts.

- Standard Trading: 0.85% (decreases as 30-day volume increases).

- High Volume Fees: Can drop as low as 0.10% for traders moving over $5 million monthly.

- BTC Market Pairs: Features a Maker/Taker model; Makers (providing liquidity) can receive a -0.05% rebate, while Takers pay 0.20%.

- AUD Deposits/Withdrawals: $0 fees for PayID, Osko, and Bank Transfers.

- Card Deposits: Typically incur a ~2% processing fee.

AUD Deposit and Withdrawal Methods

Movement of Australian Dollars is seamless, utilising the latest in domestic payment technology.

- Deposit methods: PayID (Instant), Osko (Instant), Direct Deposit (BSB/Account Number), Card.

- Withdrawal methods: Direct Bank Transfer.

- Deposit times: Instant for PayID/Osko; 1–2 business days for standard bank transfers.

- Reliability: High withdrawal limits tailored for Australian investors and SMSFs.

Trading Experience

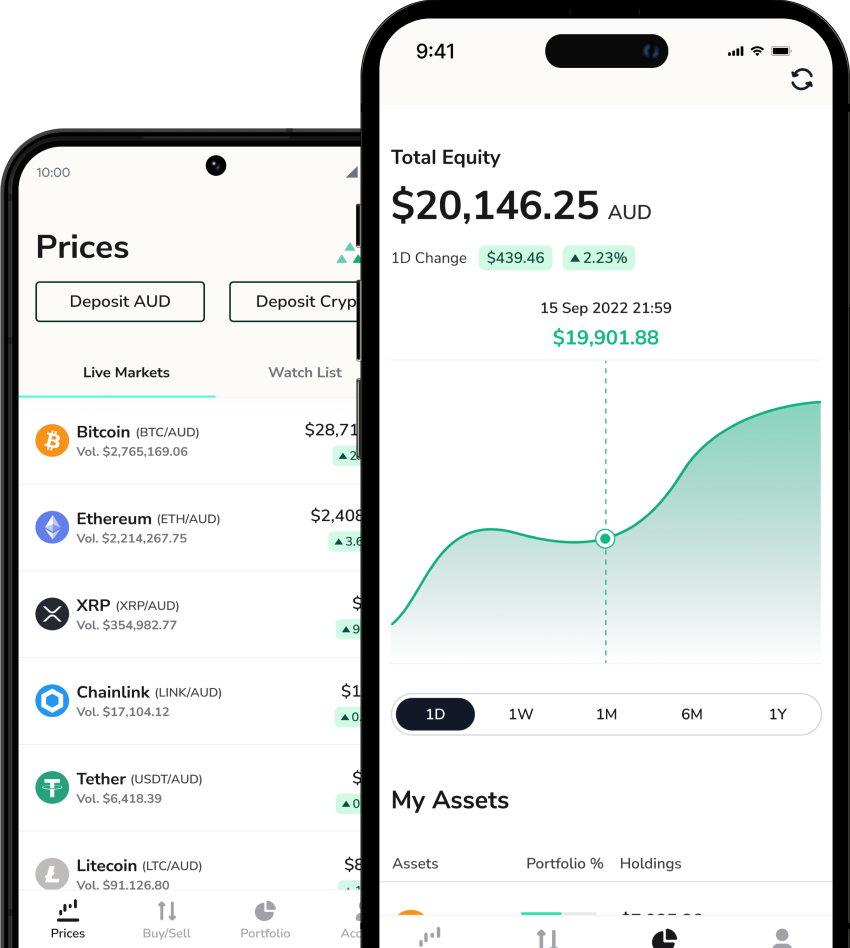

The platform is designed to scale with your skill level, offering two distinct interfaces.

- Simple Trade: A clean, “one-click” interface for buying and selling assets instantly at market price.

- Advanced Exchange: A professional-grade interface featuring TradingView charts, full order books, and advanced order types (Limit, Stop-Limit).

- Mobile App: Highly stable and focused on execution; includes P&L tracking and secure biometric login.

- API: One of the most robust developer APIs in Australia, popular for automated trading and portfolio tracking.

Additional Features

- SMSF Support: Specialized onboarding and reporting for Self-Managed Super Funds, making it an audit-friendly choice for retirees.

- Staking: Earn rewards on select Proof-of-Stake assets like SOL and ADA.

- OTC Desk: A dedicated “Over-The-Counter” service for institutional trades exceeding $100,000.

- Tax Reporting: Detailed EOFY reports designed for Australian tax accountants.

Customer Support

BTC Markets offers a reliable, Australian-based support experience, though it lacks some of the real-time chat features of its competitors.

- Channels: Email ticket system and a comprehensive Help Centre.

- Response Times: Generally within 24 hours during business days.

- Local Support: All support is handled from their Melbourne office, ensuring an understanding of local banking issues.

- User Reputation: Known for being professional and helpful with complex issues like SMSF verification.

Verification & KYC

The onboarding process is strictly compliant with AUSTRAC but optimized for speed.

- Process: Fully digital through the FrankieOne platform.

- Documents Needed: Australian Driver’s License or Passport.

- Time: Most retail accounts are verified within minutes; complex SMSF or Company accounts take 1–3 business days.

User Reviews and Reputation

BTC Markets is highly respected for its “old guard” reliability and transparency.

- Public Perception: Trustworthy, secure, and professional.

- Common Compliments: Excellent for large AUD transfers, reliable during high volatility, and great for SMSF reporting.

- Common Complaints: Higher entry-level fees compared to global exchanges and a limited selection of altcoins.

Pro’s & Con’s

Pro’s

✅ Established in 2013 with an unblemished security record.

✅ ISO 27001 Certified (Institutional-grade security).

✅ Best-in-class support for SMSF and corporate accounts.

✅ Instant AUD deposits and withdrawals via PayID/Osko.

✅ Direct AUD pairs on all assets with deep liquidity.

Con’s

❌ 0.85% entry-level fee is higher than global “Pro” competitors.

❌ Limited selection of tokens (approx. 35-40).

❌ No 24/7 Live Chat (Ticket-based support only).

Who BTC Markets is Best For

- SMSF Trustees: Those who need professional, audit-ready reporting and Australian-based support.

- High-Volume Traders: Investors who can take advantage of the lower tiered fees and OTC desk.

- Security-Conscious Australians: Those who want a platform that is ISO-certified and locally regulated.

- Professional Chartists: Users who require TradingView integration and advanced order types for AUD pairs.

How to Get Started

Final Verdict

In 2026, BTC Markets remains the premier “Institutional Choice” for Australians. It doesn’t try to be everything to everyone; instead, it provides a rock-solid, secure, and highly compliant environment for those who treat crypto as a serious part of their investment portfolio. If you value regulatory safety, ISO-certified security, and localised SMSF support over having access to thousands of risky altcoins, BTC Markets is a top-tier selection.

Now that you have all the information about whether BTC Markets is the right fit for you, it’s time to decide what’s next.