Title

Welcome to the latest edition of Capital Nexus – Shepley Capital’s crypto newsletter.

Fun Fact: Less than 7% of the global population is invested in crypto. For context, 76% of the global adult population currently hold a traditional bank account. Many Crypto investors like to imagine scenarios in their head when it comes to profits at particular price points… so let’s paint a picture for one more.

Assuming that absolutely nothing changes regarding price movement, project expansion, treasury lending, or general innovation… Simply transitioning into a digital financial society would (roughly) increase the total crypto market cap to $64 Trillion AUD ($42 Trillion USD) at bare minimum. Bitcoin would be valued at $1.85 Million AUD, with most top alts 11x in value.

Again we must emphasise that this is purely a fun scenario to think about. The only way something like this even remotely has a chance is if some powerful government/s globally declare themselves pro supporting crypto adoption…

That reminds me.. The United States, Australia, United Kingdom, & 27 other countries have already done this.

I guess some visions do become reality.

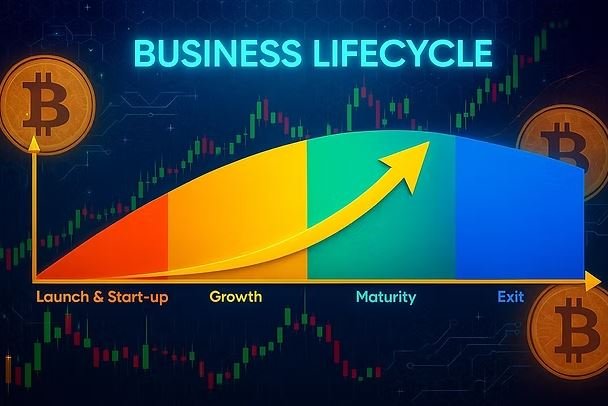

Crypto Enters Stage Two of the Business Lifecycle: The Growth Stage

If you’ve been in the crypto market long enough, you’ve probably noticed a shift this time around compared to previous cycles. Sentiment feels quieter, chart movements more deliberate. Both sparks of confidence and FUD are fading away. At first glance, it might seem like people are becoming less certain about how this cycle will play out. But if you separate emotion from objectivity, it becomes clear that we’re entering a new era of digital finance.. one moving away from hype-driven speculation and into the growth stage of real liquidity adoption.

This cycle is about regulation and infrastructure. Crypto projects are focusing their efforts on building systems that connect blockchain to traditional finance. The signs are everywhere if you know where to look. Ripple is deep into its OCC review, Chainlink is expanding CCIP integrations across major institutions, and the rise of tokenised real-world assets is finally turning theory into function.

Crypto has surpassed the stage where projects have tested market viability. It’s the same pattern seen in traditional business life cycles; a start-up teases a product, early adopters test it, and once the market validates the idea, the company moves into full-scale production and expansion.

That’s exactly what’s happening here. Take XRP, for example. Ripple has built a community of over five million people who share the same vision of revolutionising global financial infrastructure. XRP’s market capitalisation has surpassed $151 billion USD, validating the success of its use case. Having proven its concept, Ripple has since acquired multiple complementary businesses, positioning itself to compete at the highest institutional level. ETFs are beginning to open the doors for billions in superannuation, hedge funds, and investment firms to participate. Full regulatory compliance through ISO 20022 places Ripple and XRP at the forefront of global adoption.

With projects like Ethereum, Sui, Solana, Chainlink, Hedera, and Stellar building for scalability, and exchanges like Binance, Coinbase, and Kraken forming the financial rails to support them, crypto no longer follows the recognisable cycle trajectory we once knew. What’s unfolding now is the same pattern every long-term asset class eventually experiences.. mass adoption.

Macro Pressure: Rates, Equities, and the AI-Driven Capital Cycle

If you’ve felt the market tighten lately, you’re not imagining it. Liquidity is being redirected across multiple asset-classes, and for the moment, crypto isn’t where the biggest money wants to sit.

With interest rates continuing to slow things down, capital has rotated back toward safer yields, with institutions prioritising treasuries and short-term debt over volatile exposure. When the cost of money stays high, risk gets repriced. That sentimental ripple runs through everything from equities to Bitcoin. But underneath the pressure, there’s a pattern forming. The same investors pulling back from risk are positioning into infrastructure plays; AI, chip manufacturing, and tokenisation. These aren’t bandwagon rotations; they’re strategic rotations. The smart money is simply waiting for the liquidity window to reopen before expanding exposure again.

This macro phase isn’t a death sentence for crypto. It’s the cooldown before the reset. Every cycle has one. Once rates peak and the equity markets stabilise, that side-lined capital will look for asymmetric opportunity. Crypto remains one of the few markets that can still deliver it. The key is to survive the compression and be ready for expansion. Emotional investors are becoming distracted by the lack of movement. Experienced investors are awaiting the market to unfold as it always does in cycles like this. Right now we’re in the patience phase.

The US Government Shutdown Has Officially Broken Records – Here’s How It Will Affect the Crypto Market

The U.S. government has now entered record-breaking territory with its ongoing shutdown, and while headlines focus on politics, the impact runs much deeper.. especially for markets that rely on stability and liquidity.

When the government shuts down, critical financial operations slow down too. Economic data releases are delayed, departments like the SEC and CFTC freeze most non-essential activity, and fiscal spending temporarily contracts. That combination creates uncertainty, and uncertainty changes how capital behaves. For equities, that often means hesitation. For crypto, it can mean volatility. When traditional markets lose clarity, investors start repositioning. Some move toward safe havens, others toward assets that operate independently of government oversight. This is where digital assets enter the picture.

Bitcoin, in particular, tends to attract attention in these moments because it’s viewed as a hedge against dysfunction. If faith in the government’s ability to manage budgets weakens, decentralised systems start to look less speculative and more practical. But it’s not a straight line up. A shutdown can also delay regulatory approvals, ETF decisions, and policy progress, creating short-term stagnation before the next wave of inflows.

Confidence in the U.S. fiscal system is one of the core pillars of global markets. Every time that confidence is shaken, the argument for borderless, censorship-resistant financial systems strengthens. In the short term, expect slower movement and fragmented sentiment. In the long term, structural cracks in traditional finance keep building the case for crypto’s relevance.

Don’t forget to check out our Free Resources at Shepley Capital. Our goal is to publish 10,000+ Lessons, Guides & Articles to help the everyday investor succeed in their crypto journey!

See you next volume.

~ Chris Shepley

Founder of Shepley Capital