FUNDAMENTALS OF CRYPTO

NFT’s Explained: Learn what they are and how to use them

NFT’s: A New Kind of Collectible

Imagine you have a favourite trading card or a special comic book. In the physical world, you would be able to hold these things with both hands and claim individual ownership of them. In the digital world, you can do the exact same thing, minus the hand holding part. Instead of a physical item, these collectibles are stored on a computer network. We call these digital collectibles NFTs (Non-Fungible Tokens).

Until recently, digital files were easy to copy; anyone could right-click and save a photo. NFTs changed this by introducing digital scarcity. Each NFT is one-of-a-kind, like a rare baseball card or an original painting by a famous artist. While others might have a copy of the image, only one person can “own” the official version on the blockchain. You can own an NFT, trade it, or sell it just like physical items, creating a whole new economy for digital creators.

What Does Non‑Fungible Mean?

To understand NFTs, you first have to understand fungibility.

- Fungible: Items that are identical and interchangeable. A $5 bill is fungible because if you trade it for another $5 bill, you still have the exact same value. Cryptocurrencies like Bitcoin or Ethereum are also fungible.

- Non-Fungible: Items that have unique qualities and cannot be swapped 1-to-1. A movie ticket is non-fungible because it has a specific seat, date, and time. You couldn’t swap it for a ticket to a different movie and have the same experience.

An NFT is the ultimate non-fungible asset. Even if two NFTs look the same, their “digital fingerprint” on the blockchain proves they are distinct.

How NFTs Work: The Mechanics

NFTs live on a blockchain, which acts as a transparent, permanent ledger. Think of it as a public “proof of authenticity” certificate that can never be lost or forged.

Minting & Smart Contracts

The process of creating an NFT is called minting. When a creator mints an NFT, they execute a Smart Contract; a piece of code that lives on the blockchain. This contract automatically handles the transfer of ownership and manages the “metadata” (the name, description, and link to the file).

Storage & Metadata

Because blockchain storage is expensive, the actual high-resolution image or video isn’t usually stored on the blockchain. Instead, the NFT contains metadata; a link or pointer that tells your wallet where to find the image (often on a decentralised storage system like IPFS).

Verification of Provenance

The blockchain records every person who has ever owned that NFT. This is called provenance. In the physical art world, proving a painting is an original can take years; with NFTs, it takes seconds.

Types of NFT's

NFTs have evolved far beyond simple JPEG images. They now represent a wide variety of digital and physical assets:

Type | Description | Famous Example |

Digital Art | Unique pieces of art sold by creators directly to collectors. | Beeple’s “Everydays” |

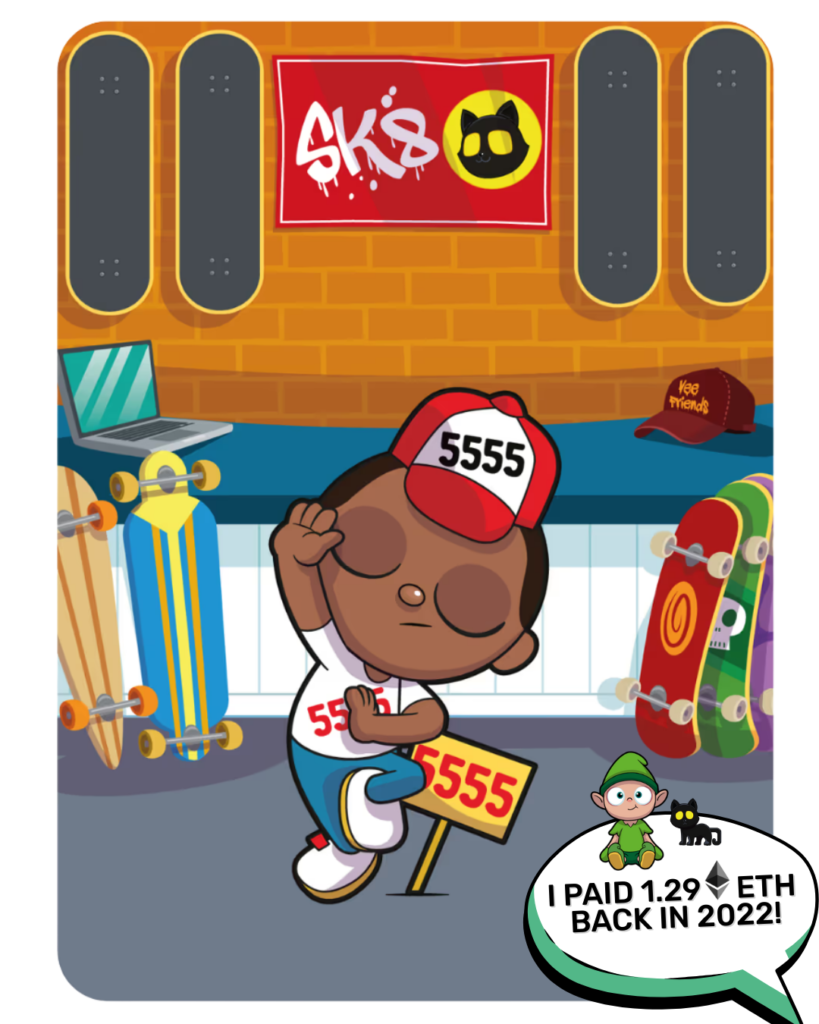

PFP (Profile Pictures) | Avatars used as digital identities in social media communities. | Bored Ape Yacht Club |

Gaming Items | Skins, swords, or land that players truly own outside of the game. | Axie Infinity creatures |

Music | Songs or albums that give fans special perks or royalties. | Kings of Leon NFT album |

Virtual Real Estate | Parcels of digital land in “Metaverse” worlds. | Decentraland plots |

Utility NFTs | Tokens that act as “keys” to exclusive clubs or events. | VeeFriends |

Why People Use NFT's

The rise of NFTs isn’t just about “buying pictures.” It offers fundamental shifts in how we value digital work:

- Creator Royalties: In the traditional world, if an artist sells a painting for $100 and it later resells for $1 million, the artist gets nothing. With NFTs, smart contracts can be set to pay the original creator 5–10% of every future sale automatically.

- Decentralisation: Creators no longer need a gallery, a record label, or a middleman. They now have the ability to sell directly to their fans (cutting out the middle person).

- Interoperability: Imagine buying a “skin” for your character in one video game and being able to wear that same outfit in a completely different game. This is the goal of NFT interoperability.

Digital Assets (NFT’s) VS Physical Assets

Feature | Physical (e.g: Pokémon Card) | Digital (NFT) |

Storage | A physical binder or safe | A digital crypto wallet |

Verification | Professional grading (PSA/ACE Grading) | Blockchain ledger (Instant) |

Resale | Ship via mail or meet in person | Instant transfer to anyone globally |

Damage | Can be torn or faded | Digital file never degrades |

Royalties | Creator gets $0 on resales | Creator can earn % on every resale |

Concerns & Challenges Associated with NFT's

While the technology is revolutionary, it is still in its “Wild West” phase.

- Speculation & Volatility: Many people buy NFTs hoping to “get rich quick.” This leads to bubbles where prices skyrocket and then crash. Many NFTs eventually lose 99% of their value.

- The Environmental Impact: Some older blockchains (like the original Ethereum) used a lot of electricity. However, modern updates (the “Merge”) and newer blockchains like Solana and Polygon have reduced energy use by over 99.9%.

- Scams & “Rug Pulls”: Because the space is unregulated, some “developers” create a project, take everyone’s money, and then disappear. This is known as a Rug Pull. Learn more about how to avoid crypto scams here.

- Copyright Confusion: Buying an NFT usually gives you the right to show off the asset, but you don’t necessarily own the legal copyright to print it on T-shirts or use it in a movie unless the contract specifically says so.

How to Buy or Sell an NFT: A Step-by-Step Guide

If you decide to participate in the NFT ecosystem, safety must be your first priority.

- Set Up a Non-Custodial Wallet: Use a trusted wallet like MetaMask, Phantom, or Coinbase Wallet. Learn more about the different crypto wallets here.

Crucial Rule: Never share your Seed Phrase (the 12–24 words used to recover your wallet) with anyone. If a site asks for it, it is a scam. - Fund Your Wallet: You will need the “native currency” of the blockchain you are using (like ETH for Ethereum or SOL for Solana) to pay for the NFT and the Gas Fees (transaction costs).

- Connect to a Marketplace: Visit a reputable site like OpenSea, Magic Eden, or Blur. Connect your wallet via the browser extension.

- Verify the Collection: Scammers often make fake copies of famous NFTs. Look for the blue checkmark next to the collection name to ensure it’s the official one.

- Confirm the Transaction: When you click “Buy,” your wallet will pop up and ask you to “Sign” the transaction. Once confirmed, the NFT will be sent to your wallet address.

Final Thoughts

NFTs represent the “Internet of Ownership.” Just as the early internet allowed us to share information instantly, NFTs allow us to share and prove value instantly. While the market is full of hype and risks, the underlying technology, blockchain-based ownership is likely here to stay, changing how we interact with art, music, and games for years to come.

Frequently Asked Questions of NFT's (FAQ)

Why can’t I just "right-click and save" the image for free?

You can! Anyone can download a digital image of an NFT, just like anyone can buy a poster of the Mona Lisa. However, the poster has no resale value and isn’t the original. The NFT is the digital deed to the work. It provides proof that you own the “official” version, which is the only version that can be resold on the market.

What are "Gas Fees"?

Gas fees are the transaction costs paid to the blockchain network to process your request (like buying or minting an NFT). Think of it like a delivery fee. These prices fluctuate based on how busy the network is. If many people are trying to use the blockchain at once, gas fees go up. We have an educational resource explaining Gas fees in detail here.

Are NFTs bad for the environment?

This depends on the blockchain census. In the past, networks like Ethereum used a “Proof of Work” system that consumed a lot of energy. However, in recent years, most major NFT networks (including Ethereum, Solana, and Polygon) have switched to “Proof of Stake,” which uses 99.9% less energy. Today, minting an NFT uses about as much electricity as sending a few emails. We have a guide breaking down the different “Blockchain Consensus types” you can access here.

What happens if the website hosting my NFT goes down?

This is a common concern. Most reputable NFTs use IPFS (InterPlanetary File System). Instead of being stored on a single company’s server, the digital file is stored across a decentralised network. Even if the marketplace (like OpenSea) disappears, your NFT and its record of ownership still exist on the blockchain and the file remains accessible via IPFS.

Can I get a refund on an NFT?

Generally, no. Blockchain transactions are “immutable,” meaning they cannot be reversed. Once you click “buy” and the transaction is confirmed, the money is sent to the seller and the NFT is yours. There is no “customer service” department for the blockchain, so double-check every detail before hitting confirm.

Is buying an NFT a good investment?

NFTs should be viewed as highly speculative. While some people have made significant profits, the vast majority of NFTs do not increase in value. You should only buy an NFT because you like the art, want to support the creator, or want the utility (like game access) it provides—never with money you cannot afford to lose.

How do I know if an NFT is "authentic"?

Before buying, check the creator’s official social media accounts (Twitter/X or Discord) for links to their collection. Scammers often upload identical images to marketplaces to trick buyers. Look for a verified badge (blue checkmark) on marketplaces and verify the Contract Address matches the one provided by the creator.