TRADING PSYCHOLOGY

Market Cycles & the Human Behaviour that Correlates

Understanding Economic and Market Cycles

All market cycles go through four different stages of economic activity:

- Expansion, where the economy grows and interest rates are low.

- Peak, where growth hits its maximum and imbalances build.

- Contraction, where output and employment decline.

- Trough, the low point before recovery.

Once the trough is reached, the cycle repeats.

Market cycles reflect how asset prices react to both fundamentals and sentiment. During the expansion stage, optimism drives buying and prices rise. At the peak, euphoria and FOMO push prices far beyond fundamentals. Contraction begins when results fail to meet expectations; fear takes hold and selling accelerates. Trough starts once prices fall sufficiently, attracting investors back in.

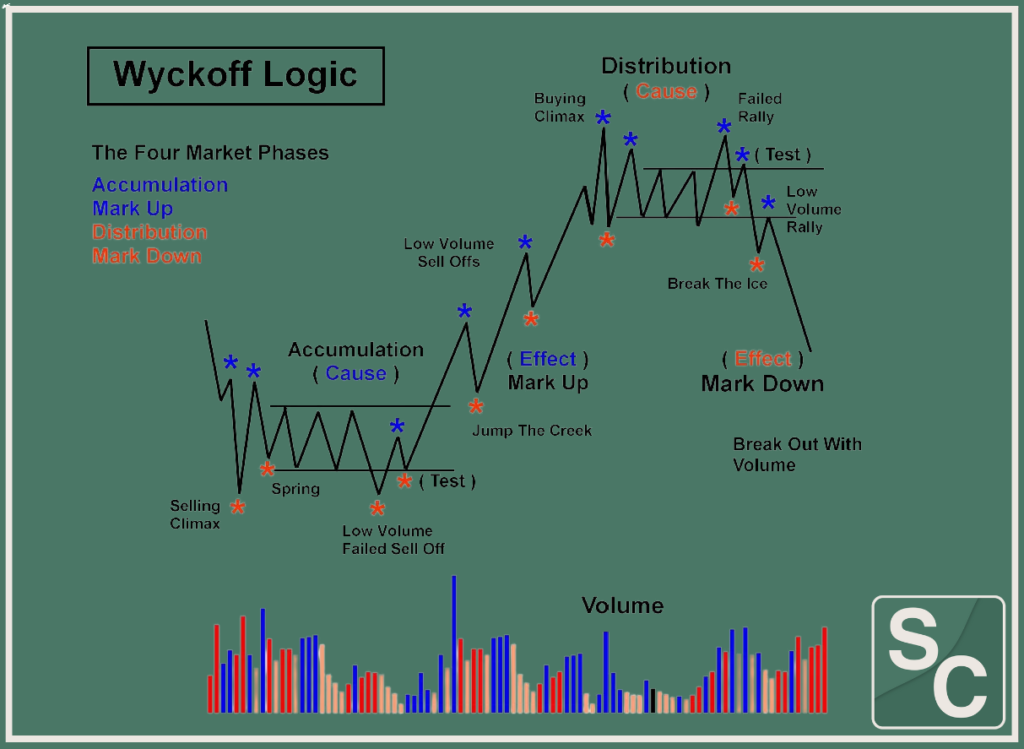

Another method considered more in-tuned with investment market cycles is through the Wyckoff‑style stages: accumulation, markup, distribution and markdown. Accumulation is characterised by sideways price action as institutional investors slowly build positions. Markup occurs when the price breaks above resistance and gains momentum. Distribution is the topping phase where early buyers exit and volume increases but prices stagnate. Markdown (decline) happens when selling overwhelms buying, sending prices tumbling until a new accumulation phase emerges. Continue learning about Wyckoff’s Style stages here.

Understanding both these frameworks can be a profitable knowledge base to acquire as both the economic fundamentals and investor sentiment are naturally interlinked. When optimism and euphoria dominate, valuations stretch, and when fear and despair dominate, fundamentals improve while prices remain depressed. Recognising where the market and economy are in their respective cycles helps investors set realistic expectations and avoid emotional extremes.

The Cycle of Investor Emotions

Psychology plays a major role in how markets move. Because markets are made up of people, the collective feelings of those people create a repeatable cycle of emotions. This journey usually follows a specific path as prices rise and fall.

The Stages of the Emotional Cycle

The investing journey often begins with optimism. At this stage, a positive outlook leads people to buy. When they see early gains, they feel a sense of excitement and thrill, which makes them feel like smart investors.

The peak of the market is marked by euphoria. This is the point of maximum financial risk. During euphoria, quick profits cause people to ignore danger and trade more than they should. They believe the good times will never end.

When prices start to drop, the mood changes quickly:

- Anxiety and Denial: Investors hope the drop is just a temporary “glitch” and ignore the signs of a downturn.

- Fear and Panic: As losses get larger, reality sets in. People begin to worry they will lose everything.

- Capitulation: This is the point of maximum “pain.” Investors often sell their assets at any price just to make the emotional stress stop, often vowing never to invest again.

Eventually, the market reaches a bottom. As prices slowly begin to rise, the cycle starts over with hope and relief as confidence gradually returns to the market.

Learning to become a successful Trader means ignoring your emotional state when decision- making. Solely relying on technical analysis & fundamental analysis is what positions you towards success, & away from the failing majority. View the “Psychology of a Successful Day Trader and Investor” here.

How Human Behaviour Drives Market Cycles

Why do investors tend to repeat these same mistakes in every cycle? The answer lies in “behavioural finance”: the study of how our natural human instincts can lead us to make poor financial choices.

Common Psychological Biases

Our brains are wired for survival, not necessarily for trading. This leads to several common biases:

- Herd Mentality This is the tendency to follow the crowd. When everyone else is buying, it feels safe to join in. This “herd” behaviour pushes market bubbles higher. When everyone starts selling, it causes crashes to happen faster.

- Loss Aversion Humans feel the “pain” of a loss much more strongly than the “joy” of a gain. This bias often causes people to panic sell during a downturn to “stop the bleeding,” even if their long-term plan was to hold.

- Overconfidence After a few successful trades, many people begin to believe they have a special ability to “time the market.” This leads to taking on too much risk and ignoring the facts of a situation.

- Recency Bias This is the habit of assuming that whatever happened recently will continue forever. If the market has been going up for a month, recency bias makes us believe it will never go down again.

The Power of FOMO

The Fear of Missing Out (FOMO) is one of the strongest drivers of market cycles. When prices are rising fast (the “markup” stage), greed takes over. People throw caution aside and buy assets at high prices because they are afraid of being left behind while others get wealthy. We recommend reading our resource on the mistakes of avoiding market psychology if you’re someone who struggles with knowing when enough is enough.

Breaking the Pattern

These biases combine with global economic forces to create the cycles we see in crypto and stocks. Recognising when your decisions are being driven by a “feeling” rather than a “fact” is the first step toward becoming a disciplined investor. By understanding these patterns, you can learn to stay calm when the “herd” is panicking and remain cautious when the “herd” is euphoric.

Strategies to Navigate Market Cycles

Although you can’t control market movements, you can control your responses. Professionals recommend:

- Have a long‑term plan. Define your goals, time horizon and risk tolerance. A clear plan helps you stay focused when markets swing.

- Automate contributions. Strategies like dollar‑cost averaging or systematic investment plans remove timing decisions and reduce emotional impulses.

- Diversify and rebalance. Spreading investments across asset classes cushions volatility. Rebalancing forces you to sell high and buy low—counteracting herd behaviour.

- Limit news consumption and avoid daily monitoring. Bajaj warns that checking markets daily increases anxiety; staying focused on the long term helps.

- Invest regularly and stay educated. Regular investing through SIPs or recurring contributions builds discipline, while learning about behavioural finance and your own biases improves self‑awareness.

- Talk to a professional. An advisor can provide objective guidance when emotions run high. Reach out to a member of the Shepley Capital team to learn more.

- Consider contrarian thinking. Investors who resist herd mentality and buy undervalued assets during despair may benefit when the cycle turns. However, contrarian strategies require patience and sound analysis.

Final Thoughts

Markets are dynamic, but human behaviour is remarkably consistent. Booms are born from optimism and euphoria; busts from fear and despair. Understanding both the economic backdrop and the emotional journey investors travel grants the investor a substantial advantage in viewing the opportunity of a moment rather than the catastrophe unfolding. Stay disciplined, diversify, automate where possible and cultivate awareness of your own biases. Over the long run, your behaviour will have the largest impact on your returns.