How To Build a Long-Term Crypto Portfolio | Capital Nexus - By Shepley Capital

Welcome to the latest edition of Capital Nexus – Shepley Capital’s crypto newsletter.

We may have gone slightly overboard with value in this one…

🏦 The Next Frontier: Tokenised Real-World Assets (RWA)

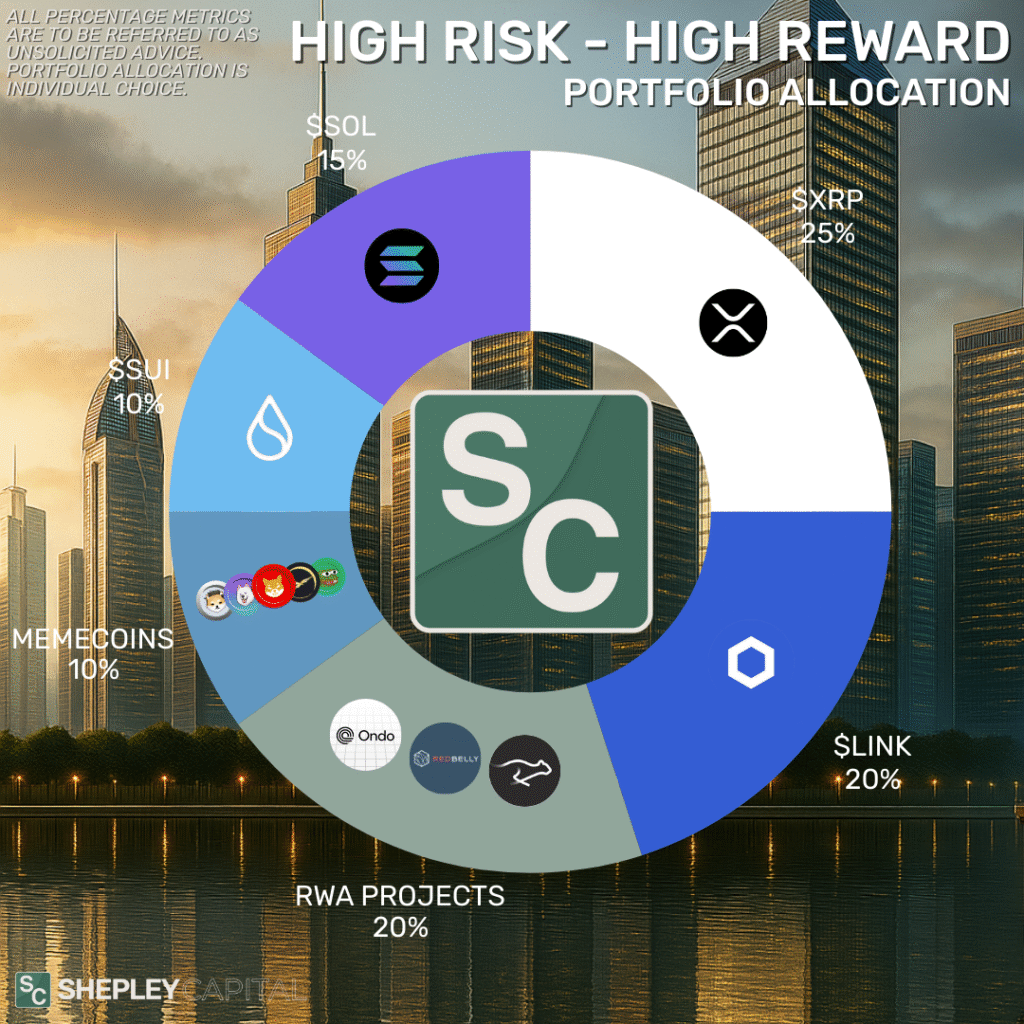

While most investors fill their portfolio with long-shot Memecoin plays or overextended alt-coin positions, some of the biggest institutional bets are flowing into Real-World Assets (RWA).

What are RWAs?

RWAs are physical or traditional financial assets; such as treasuries, real estate, commodities, bonds, etc, that are represented on the blockchain as tokens. They make illiquid markets liquid, transparent, and borderless. Essentially, these tokens bring a way for investors to enter fiat markets through crypto.

There are three massive advantages that get introduced with RWA portfolio expansion:

Access to Yield That Was Previously Locked Away

Investors can tap into yields from U.S. Treasuries, real estate, or private credit, markets that were once gated to institutions or the wealthy.

24/7 Liquidity & Borderless Trading

Instead of waiting weeks or months to settle, tokenised RWAs can be traded instantly on-chain, with no borders, middlemen, or banking hours in the way.

Transparency & Fractional Ownership

Blockchain ensures every transaction is auditable, while tokenisation lets investors own fractions of high-value assets (like real estate or bonds) that would otherwise be out of reach.

👉 The opportunity: RWAs might not offer 1000x returns, but they are the bridge between traditional finance (TradFi) and DeFi, making them a long-term bedrock play in any serious portfolio.

🧠 The Psychology of Alt-Season

We’re currently in the stage of Alt-season where the market is progressively up-trending, but is yet to see that ‘break-out’ push that everyone is waiting for. For many, this time can be psychologically testing, knowing that any day could be the start of a cycle that is four years in the making. If you had any skin in the game back in 2021, you’ll remember how quick that bull run came and went. In fact, 2021 was most casual investors’ first bull run. But what those same casual investors won’t tell you is that the majority of them actually lost substantial profit due to one thing… greed. The idea that a run so good would eventually do a complete flip was incomprehensible to some, yet became a reality for many. Within a week, the charts fell over 40%, with one notable day seeing a 26% dump across most top 25 projects. Billions were wiped from the market, right into the pockets of those who knew how to play the ‘crypto game’.

The good news is, knowing how to play the ‘crypto game’ no longer requires guesswork. Safe practice guides & informed trading strategies are starting to become public knowledge. But still to this day, and most likely everyday into the foreseeable future of investing there will always be one psychological trait that many simply cannot master… the ability to be objectively informed.

As an investor, your top priority should always be to invest in assets that offer the highest return on investment (ROI), matched with the lowest relative risk. In the world of crypto, this pairing is more than attainable for most, but only if you leave emotion at the door and rely on objective strategy to guide your decision making. With this said, now’s the time to point out that the following strategy is primarily built for investors focused on the here & now, not the investors that are in it for the 15+ years long-run. For those that are investing for the decades, strategy is simple; Invest in 3-5 top crypto projects, automate dollar cost averaging (DCA) every week/month just like you would with the S&P500, check back in 15 years from now to see a very healthy profit. Now for those investors focused on the here & now, here is a detailed strategy to follow that takes market psychology into consideration, whilst eliminating personal emotion from the decision making process. This is especially useful if you’re someone who doesn’t have a great deal of time throughout the week to focus on your crypto investment portfolio.

Define Your Goals & Allocate Accordingly

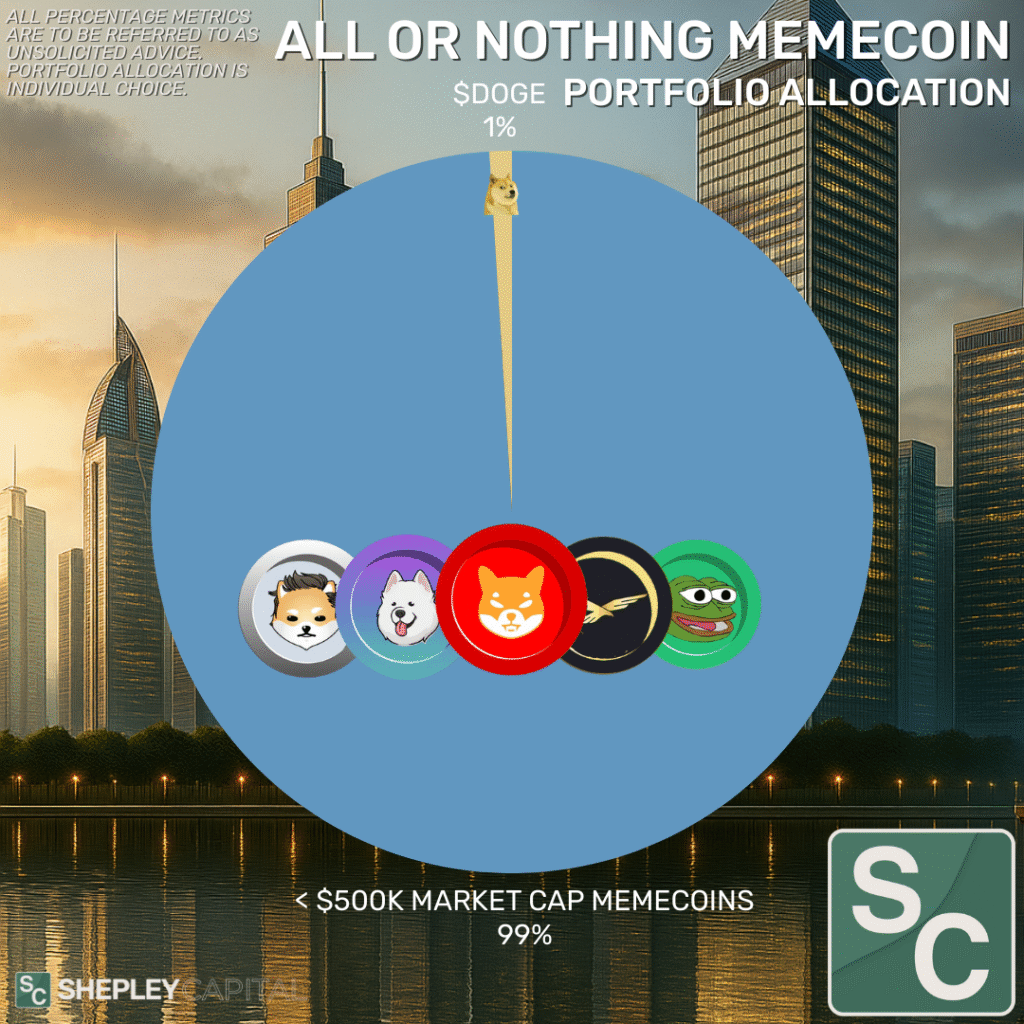

First, choose 3-5 assets you believe in long-term (e.g. BTC, ETH, XRP, an RWA token, an AI token). Base this selection on the combination of project fundamentals & adoption trends. For example: Bitcoin is leading the global adoption stage with strategic reserves being created globally. This is a winner. Ethereum is leading global blockchain usability & adoption metrics based on their multi-billion dollar weekly processing statistics. This is a winner. Shiba inu is a running internet meme that performed well in the 2021 market, yet has failed to rebuild that momentum that once rocketed it through the charts. This is a Loser.

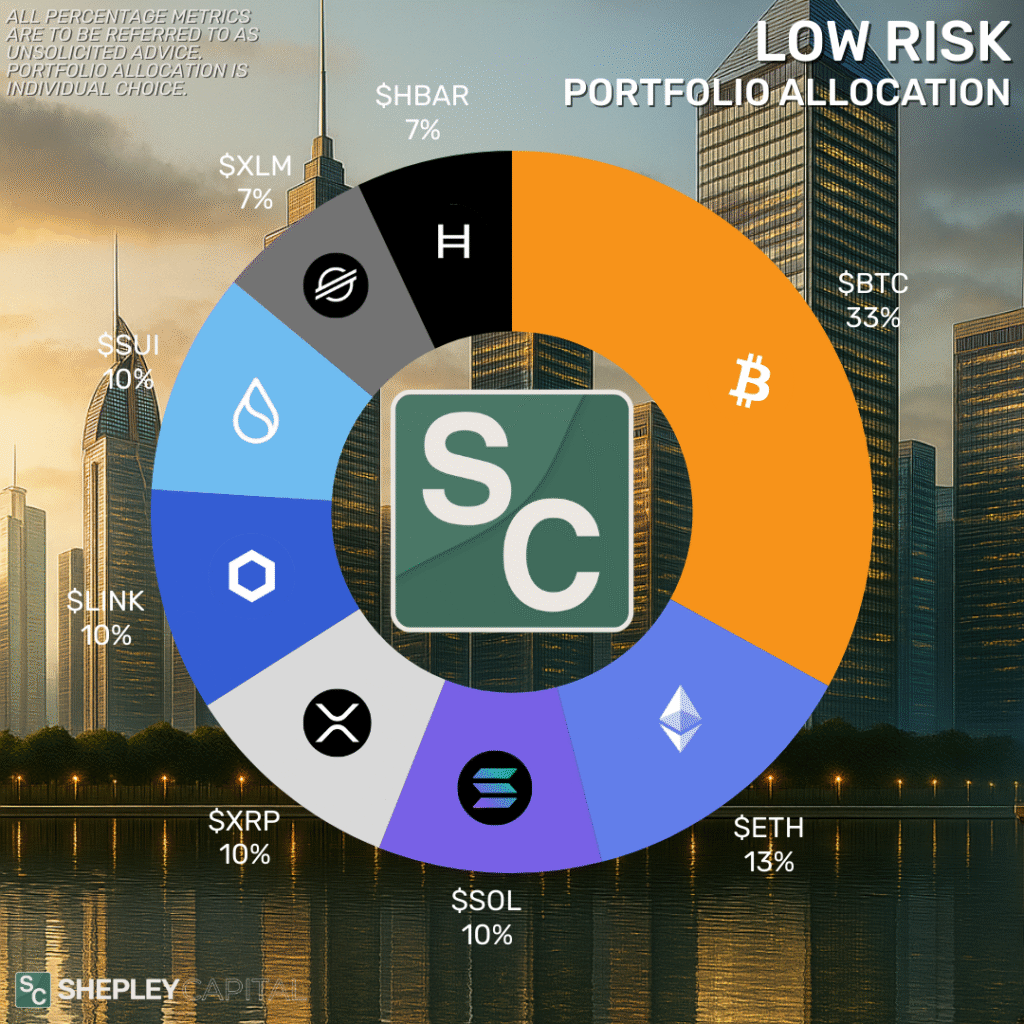

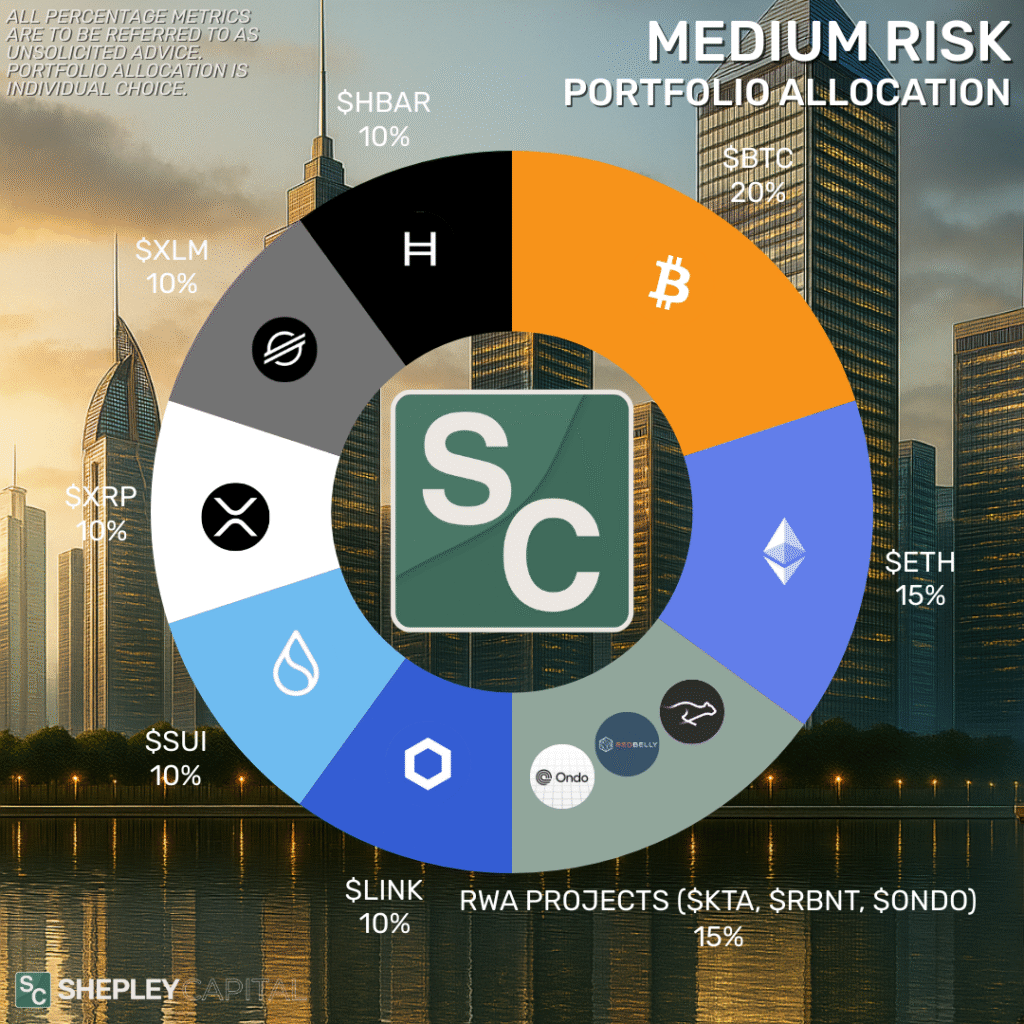

If your investing strategy is for long-term growth at lower risk, lean your allocation towards Bitcoin & Ethereum. If your investing strategy is more on the medium risk, promising reward side; consider projects such as $XRP, $LINK, $SUI as core selections that maintain high investor confidence scores, yet retain room for progressive growth. For help with asset allocation guidance, refer to our next headline article story.

Automate Your Entry (Dollar-Cost Averaging)

Next, automate your entry through dollar-cost averaging. Setting recurring buys weekly or bi-weekly removes decision fatigue and ensures you’re accumulating even when the market is fearful. Over time, this balances out highs and lows without the pressure of timing the market.

Set Pre-Defined Profit Targets (Greed Control)

To control greed, set pre-defined profit targets. For example, sell 25% of your position after a 75% gain, another 25% after a 125% gain, and keep a core holding for the long run. This way, you secure profits before the urge to “hold forever” takes over.

Build in Downside Protection (Fear Control)

On the downside, build protection against fear by deciding your maximum acceptable drawdown (stop-losses). If your portfolio dips below 20% (as an example), rotate into Stablecoins/fiat. This prevents panic-selling at the absolute bottom.

Align with Market Cycles (Macro Psychology)

It’s also important to align with market cycles, which are driven heavily by psychology. In accumulation phases, when nobody is talking about crypto, quietly keep buying (increase DCA). In euphoric phases, when mainstream FOMO takes over, scale out and take profits. During bear markets, when fear dominates, hold off on selling and resume steady accumulation.

Review your investing strategy monthly

Finally, review your entire investment strategy on a monthly basis. Whilst this ensures safety from any intangible factors that may arise, this also will keep your decisions rational, emotion-free, and saves you valuable time.

📈 Building a Long-Term Crypto Portfolio (2025–2030)

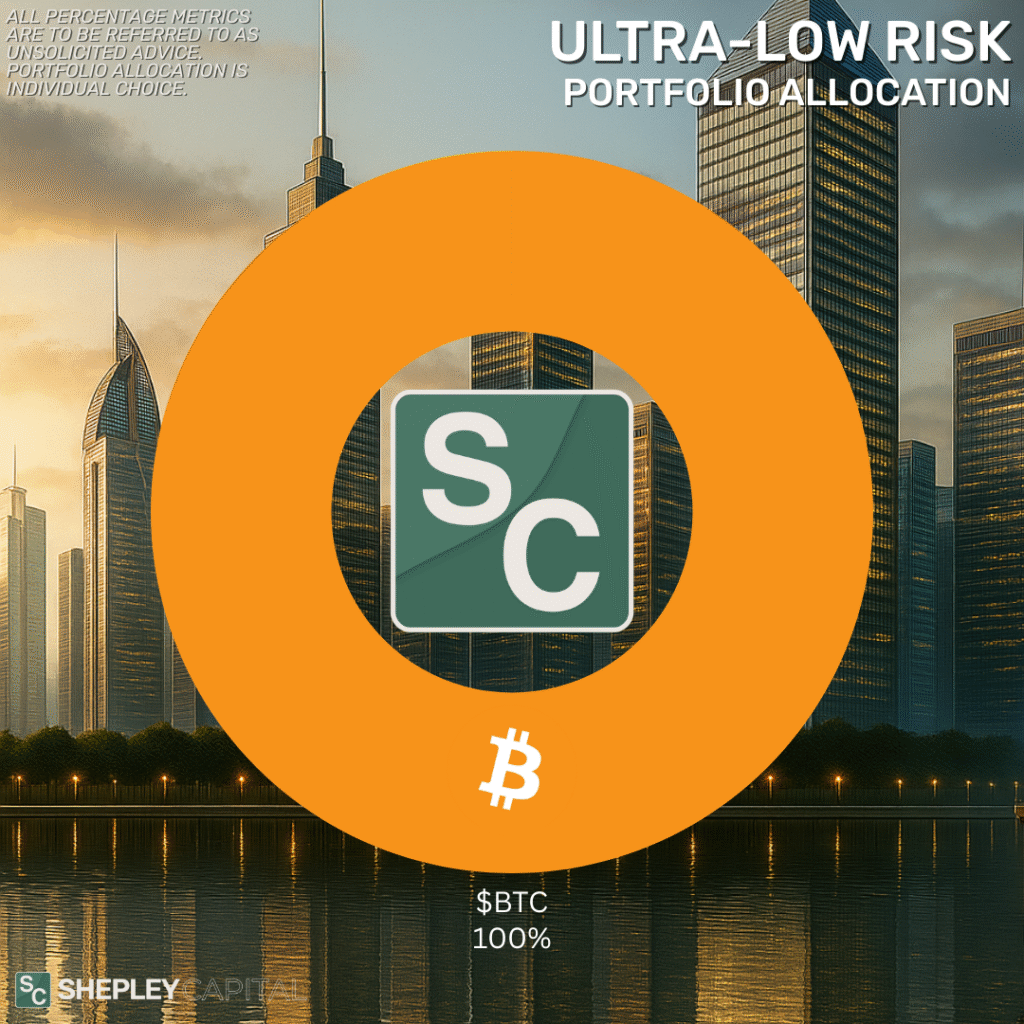

As guidance for electing your portfolio allocation assets, here is a Complete Crypto Portfolio Allocation Guide; Based on Risk Tolerance, Tailored for the Everyday Investor, based on how to build a long-term crypto portfolio.

This guide is designed for newer Crypto investors who are either learning about the space, or keen on comparing their own portfolio allocations. Keep in mind that some projects listed are interchangeable based on investor preference. Everyone has unique goals, and as such unique projects may be better suited.

If there’s one thing to remember when deciding which portfolio allocation strategy to adopt, it’s to figure out exactly what you’re investing for. Whilst it may sound like a pointless exercise, those who are investing for the kids’ university fund tend to follow a much lower risk profile over those who are investing in their own financial gain.

🧰 Accumulation vs Distribution Zones: Spotting the Smart Money

In crypto markets, two patterns dominate price behaviour: accumulation and distribution. Understanding the difference is critical. Most retail traders buy at the wrong time; at tops during hype, and sell at the wrong time; during bottoms when fear dominates. Spotting these zones early is what separates consistent traders from emotional participants.

Accumulation Zones

Accumulation happens after a downtrend. Prices often appear “boring,” moving sideways while volume slowly grows. This is when smart money figures are quietly entering positions. Large investors, whales, & institutions take advantage of weak hands and low participation to build their stacks at discounted prices.

Some key signs:

Sideways price action after a clear downtrend. Prices aren’t breaking out, but there’s noticeable volume.

Volume growth without price movement — this indicates accumulation without pushing price higher yet.

Fake breakdowns or “bear traps” designed to scare retail traders into selling.

Distribution Zones

Distribution is the opposite: it occurs after a strong uptrend. Smart money begins taking profits while retail traders are euphoric, chasing gains. Price may appear volatile with spikes in volume, but higher highs are weak or absent.

Signs of distribution include:

Choppy or sideways price action following a steep uptrend.

Volume spikes without upward progress, often a warning that sellers are overwhelming buyers.

Bull traps and exit pumps, whales create temporary rallies to lure retail into buying, then sell into that demand.

Practical Tips for Investors

Watch volume relative to price: Sideways movement on high volume signals accumulation; sideways on declining volume after a bull run can indicate distribution.

Identify patterns of “fake moves”: Sudden drops in accumulation zones or quick spikes in distribution zones are rarely random.

Align with smart money, not hype: Enter during quiet periods, exit before public excitement peaks.

Key Principle: Smart money enters during boredom; retail enters during hype. By aligning yourself with patience and observation rather than emotion, you put yourself in the position to profit from major market moves while avoiding common traps.

Closing Thoughts

The market’s noise will always tempt you; the next meme coin, the next breakout chart, the next social media pump as declared by your local content creator. But real wealth in crypto comes from a blend of vision & discipline.

The remainder of the year is expected to deliver fireworks, but those celebrations will soon after come to a close. Those who prepare strategy frameworks today will look back in 5 years and realise this was the foundation of their success.

Stay sharp. Stay patient. Stay ahead.

See you next volume.

~ Chris Shepley

Founder of Shepley Capital