Will September 2025 surprise the crypto market? | Capital Nexus - By Shepley Capital

Welcome to the latest edition of Capital Nexus – Shepley Capital’s crypto newsletter.

September has a reputation in the crypto markets: it’s historically the month of red candles and fading momentum. But what if this time is different? What if crypto breaks the seasonal curse and flips the script, catching investors off guard?

We’re heading into a period where macro pressure, ETF speculation, and on-chain signals are priming for a rally. The final third of this year will be anything but boring, and as always, objective discipline and data will give investors the edge over the majority of the emotional market.

Market Pulse: ETFs on the Horizon

The SEC are currently sitting on more than 90 new crypto ETF applications that are in the works, spanning across XRP, Solana, Dogecoin, and other high profile projects. According to multiple sources, the next 12–18 months is expected to bring “hundreds of crypto-related ETP launches” into the public market.

Some people have been asking for guidance on what the difference is between buying a crypto ETF & purchasing the crypto itself. In simple terms; you’re essentially choosing whether you want to buy the asset with or without the added requirement of storing it yourself. For example, if you were to purchase any project today, let’s say BTC, and store it on your hardware wallet (cold wallet), you would be considered the sole-custody owner of that asset. However, if you decided that the added requirement of self-protection of your asset was too difficult to manage, the option of an ETF allows the investor to own the asset on paper, but not be in possession of BTC physically. Just like if you were to own shares in the S&P 500; that doesn’t mean that you now own 500 companies where you can go change the wallpaper on their walls, but on paper you have contributed financial support in the short-term in expectation of a greater financial return in the long-term.

The market spotlight is all on the pending XRP ETFs. Several applicants have recently amended filings, which often signals a public launch could be near. But the news doesn’t stop there.. On August 7, 2025, US President Trump signed an executive order directing federal agencies such as the Department of Labor (DOL) & the SEC to revise guidance and make way for alternative asset classes, including cryptocurrencies, private equity, real estate, and hedge funds, in 401(k) retirement plans. Previously, digital assets were effectively blocked in managed retirement plans because of DOL guidance that advised fiduciaries to “exercise extreme care” with crypto options. That guidance was fully rescinded in May 2025. To put into perspective this scale of opportunity: The order potentially opens up between $9 and $12 trillion in retirement savings to investment in crypto and other alternative assets.

Geopolitics: BRICS Eyes the XRPL

In their most recent public filings, BRICS nations made direct references to the XRPL (XRP Ledger). Here’s why this could potentially be very significant within the XRP ecosystem. This is not just another passing mention of blockchain. The BRICS alliance (Brazil, Russia, India, China, South Africa, plus new members like Saudi Arabia and Iran) has been actively pursuing alternatives to the U.S. dollar–dominated financial system. By pointing to XRPL, they may be exploring how Ripple’s technology could support cross-border settlement frameworks.

The XRPL is designed for fast, low-cost, and scalable transactions, which makes it particularly suited for multi-national payment infrastructure. If adopted at scale, it could give BRICS countries a new way to settle trade outside of SWIFT or dollar-backed rails.

Such a move would represent more than a technical upgrade. It would mark a potential shift in global financial power, reducing reliance on Western-controlled systems and opening the door to a more multipolar monetary structure. Overall, certainly something to watch, and something we’ll keep you updated on as the months go by.

Market Reality Check: Hype vs. Wealth

A new month calls for a new Meme-coin for people to go crazy about.. Only to lose the majority of their investment within the first 24 hours. And not to our surprise.. It’s happened again.

For context, World Liberty Finance positioned itself as a “Trump-aligned financial movement,” branding $WLFI as the flagship token of their platform. Directed by Eric Trump, son of US president Donald Trump, the project leaned heavily on political branding, banking on hype, headlines, and narrative-driven marketing rather than real utility.

Whilst all this makes for a great public marketing story, no matter how flashy the packaging, the market doesn’t lie. Meme-driven, politically branded projects rarely sustain momentum once the initial hype fades. $WLFI is no different.

Having already fallen 40% just 5 days after its public launch, a staggering amount of investors have lost out to yet another meme-coin launch, Infact, approx 95% of all wallet holders have occurred a red balance. As much as we want to console those investors, patting them on the back saying that “If any meme-coin had a chance, It would be one launched by the son of the active president”.. We somehow can’t even do that.

On January 17th, the $TRUMP token was launched to celebrate his inauguration. It’s now fallen 73% since launch.

On January 19th, literally just two days later, the $MELANIA token was launched. Surely it couldn’t be much worse than the $TRUMP token… wrong, It’s now fallen 98% since launch.

No matter how many times this happens, people still convince themselves that the next political meme coin is going to 1000x their portfolio overnight.

All it took $WLFI was 24 hours after public launch to drop 24%.

It’s at this point that we want to clarify the entire purpose of Cryptocurrency. It was never built to be a quick-cash casino where meme projects pump and dump overnight. The foundation of crypto is decentralization, transparency, and financial sovereignty. It’s about creating an alternative system outside the control of central banks, where individuals have full ownership over their money and the freedom to transact globally without intermediaries.

When people chase hype coins expecting 1000x returns, they miss the bigger picture. The true wealth in crypto comes from understanding the technology, accumulating strong assets, and holding through cycles. That’s the purpose, and that’s where the opportunity lies.

Long-term investing = long-term wealth.

Simple as that.

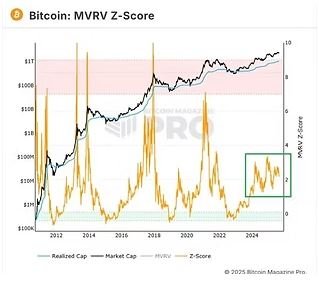

Chart of the Month: MVRV Z-Score

This is the MVRV (Market Value to Realized Value) ratio, known as one of the best on-chain tools to measure Bitcoin’s true valuation.

When MVRV is high, it means the market value is trading well above the realized value (the average price where coins last moved). In simple terms: Bitcoin is overvalued, and smart money begins to take profits.

When MVRV is low, Bitcoin trades near or below the average cost basis of holders, meaning BTC is undervalued and historically a great accumulation point.

Every bull run cycle in Bitcoin’s history has topped when the MVRV Z-score reached the 7–10 range (The Red Zone). Whenever we’ve hit that zone, the market has entered its blow-off phase, followed by a top. So far in this cycle we’re absolutely nowhere near it. Bitcoin’s current Z-score hasn’t even sniffed those historical extremes. By the numbers, we’ve only completed around 55% of the climb in this run. As we are in September 2025 of this crypto market cycle, that leaves us with less than 4 months for price to get moving.

So If reliable history repeats, then a Z-score of 7 this cycle projects approx a $150K Bitcoin price. That’s the target we’re eyeing. Whilst that covers the lower side of the red zone, we’re realistically projecting that Bitcoin won’t surpass much, if any above $150K this cycle. Who knows, maybe Bitcoin might surprise us with another 40% rally, but we’re willing to admit that Bitcoin’s 136% rise in price since this time last year has made for a pretty good cycle already.

Closing Thoughts

In 20 years, when you look back at your crypto journey, you certainly won’t be able to call this time in the financial revolution boring. This market has had more twists than a Netflix dating show.. And that’s only talking about the past 200 days. But being an early investor in the next revolution of global finance takes conviction, a trait that every serious holder possesses. That includes you.

The coming months will test that conviction, and we truly believe that you will be rewarded because of it. Our one piece of advice to close out is this:

“Remember to take profits throughout the next 100 days. Don’t let this be another cycle where you waited that bit too long, only to lose 5% overnight.. And then hold out yet again in an attempt to make back that lost 5%, only to lose another 7%. Be satisfied with taking profits 5% too soon then losing 10% by selling too late”.

At Shepley Capital, our goal is to help you navigate the noise, decode the data, and position for long-term wealth. Markets will always be driven by emotion. Narratives will always shift with the headlines. But history shows one constant; discipline is undefeated.

See you next volume.

~ Chris Shepley

Founder of Shepley Capital