Crypto is on the Verge of Complete Global Adoption | Capital Nexus - By Shepley Capital

Welcome to the latest edition of Capital Nexus – Shepley Capital’s crypto newsletter.

Kick Off: Unlock a $90 Gift by Referring a Friend

We’re rolling out a super simple way to get your hands on the Capital Success Day Trading Playbook (normally $90) at absolutely no cost.

If you refer 10 people to Subscribe to our Capital Nexus newsletter, we’ll send the playbook straight to your inbox the next day – no strings attached!

It’s a straightforward way to help others discover what we do and get a little reward for spreading the word.

Bitcoin Surpasses Visa & Mastercard for the Third Year in a row

For the third year in a row, Bitcoin has surpassed both Visa and Mastercard in total transaction value over the fiscal year.

This is a significant milestone that continues to be overlooked by many outside the digital asset space. Visa and Mastercard are two of the largest payment networks in the world, processing trillions of dollars annually across global commerce. Bitcoin now settles more value each year than either network, without relying on banks, offices, or fixed operating hours.

Unlike traditional payment rails, Bitcoin operates continuously. Transactions clear 24 hours a day, across borders, without requiring approval from intermediaries. The network does not pause for weekends, holidays, or geopolitical friction.

What makes this trend notable is not just the raw numbers, but the consistency. This is not a one year anomaly driven by market spikes or unusual activity. It marks the third consecutive year in which Bitcoin has processed more total transaction value than legacy payment giants.

As traditional finance continues to face rising costs, settlement delays, and increasing regulatory complexity, Bitcoin’s role as a global settlement layer is becoming harder to ignore. For investors, this reinforces the idea that Bitcoin is no longer just a speculative asset, but an increasingly important piece of financial infrastructure.

This shift is happening quietly, measured in transaction data rather than headlines. But its implications for the future of payments and value transfer are substantial.

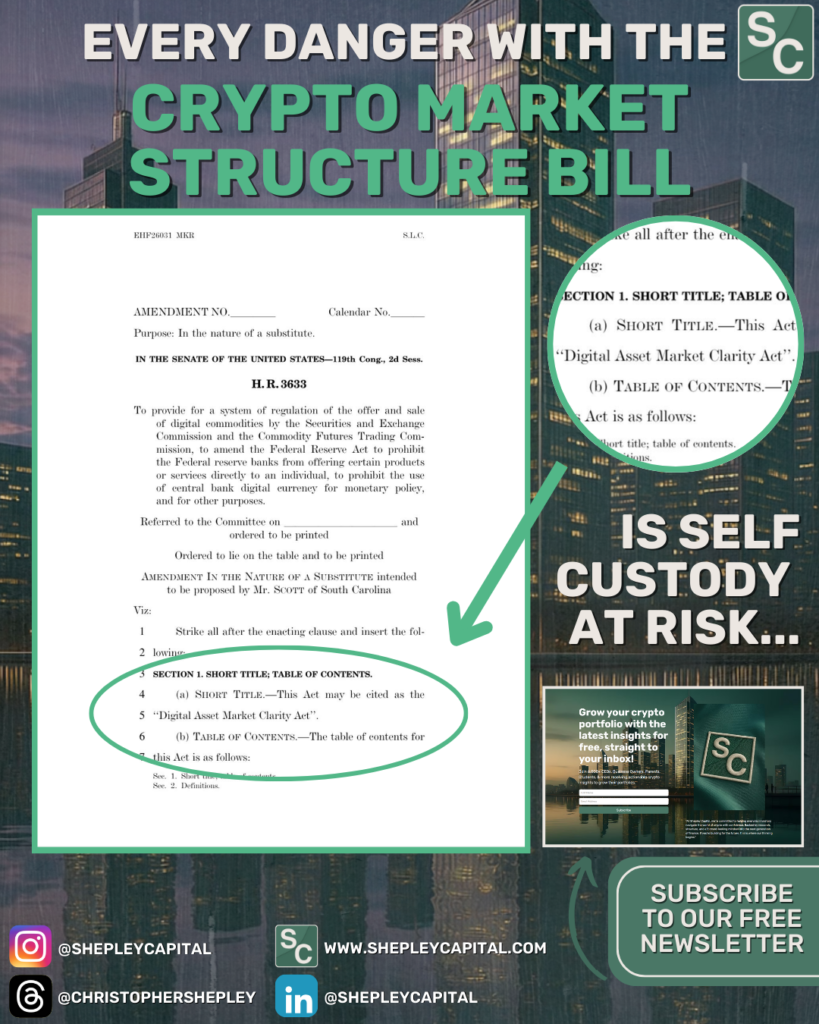

Why the U.S Clarity Act Matters to Crypto Holders Globally

Before we break down what happened over the last few days with the Clarity Act, it’s important to understand how this bill affects you as a holder and investor. In its draft form, the clarity act bill being presented in the U.S impacts how you hold crypto, earn rewards, use DeFi, and access new onchain investment options.

As someone who lives outside of the U.S, you might be asking the question: “Why does a U.S policy matter to me”? – Here’s how.

Most western countries typically adopt near identical protocols into their own laws & regulations within the first 3 months of publication. We see this across most sectors of our regulatory ecosystem; from health, finances, laws, & as of recent times.. social media age restrictions.

With that said, here’s exactly what has unfolded over the past few days regarding the Cryptocurrency Clarity Act bill in its draft form.

Pushback with the Clarity Act Draft

On Friday, January 16, 2026, major developments broke in the U.S. crypto policy world. After intense industry pushback, the Senate Banking Committee postponed and effectively cancelled the markup vote on the Clarity Act that had been scheduled for this week.

This shift came after Coinbase CEO Brian Armstrong publicly withdrew his company’s support for the legislation in its current form, stating that the draft would leave the industry in a worse position than the current status quo and that Coinbase “would rather have no bill than a bad bill.”

Armstrong’s comments were echoed across the crypto community and were pivotal in delaying the vote. Key concerns included the potential ban on tokenized equities, restrictions on DeFi, excessive regulatory control favoring the SEC over the CFTC, and clauses that would kill passive stablecoin rewards, all of which could negatively affect innovation and investor choice.

As a result of this industry pushback, the Senate Banking Committee canceled the vote and marked up the session originally set for this week. Lawmakers acknowledged that the draft text did not have the support needed to move forward and that continued negotiations are essential.

What Will Happen Next?

Senators have indicated they plan to go back, rework the language, and attempt to strike a better balance between regulatory clarity and preserving the innovative elements of the crypto ecosystem. Industry insiders and lawmakers both stress the importance of creating a framework that protects consumers while still encouraging technological growth and competitiveness.

For holders and investors, this delay is a reminder that regulation is still very much still under development, and that market structure legislation can have far-reaching effects on asset utility, privacy, yield opportunities, and innovation incentives if not developed adequately. The hope across the crypto community is that lawmakers will address the concerns raised, especially those around tokenized assets and decentralised finance, and produce a version that aligns more closely with investor interests and global competitive pressures.

ATO Crypto Rules: What Every Aussie Investor Needs to Know

Cryptocurrency has taken Australia by storm, and with it comes the tax man’s keen interest. The Australian Taxation Office (ATO Crypto rules) have made clear that crypto investors must play by the rules when it comes to taxes. Whether you’re a casual Bitcoin HODLer, an NFT artist, or a high-frequency trader, it’s critical to understand how the ATO’s crypto tax rules affect you. This comprehensive guide breaks down everything – from capital gains on your trades to the nuances of staking income – so that both new and experienced crypto investors can stay informed and compliant.

In this guide, we’ll cover all the essentials of Australian crypto taxation in plain English. Expect clear explanations, examples, and actionable tips on minimising your tax legally. We’ll also point you to further resources (like our Cryptopedia lessons) for deeper dives into foundational crypto topics where needed. By the end, you’ll have a superior grasp of ATO crypto rules – making this your go-to resource Australia-wide for crypto tax knowledge.

Access the full Educational Resource here

See you next volume.

~ Chris Shepley

Founder of Shepley Capital