CRYPTO TAX & REGULATIONS

Capital Gains Tax for Cryptocurrency in Australia

What Are Capital Gains and Capital Losses?

In Australia, Capital Gains Tax (CGT) applies whenever you sell, swap, or otherwise dispose of a crypto asset. This includes trading one coin for another, selling for fiat, or using crypto to buy goods or services.

- A capital gain occurs when your crypto’s sale price exceeds your cost base (what you originally paid for it, including fees).

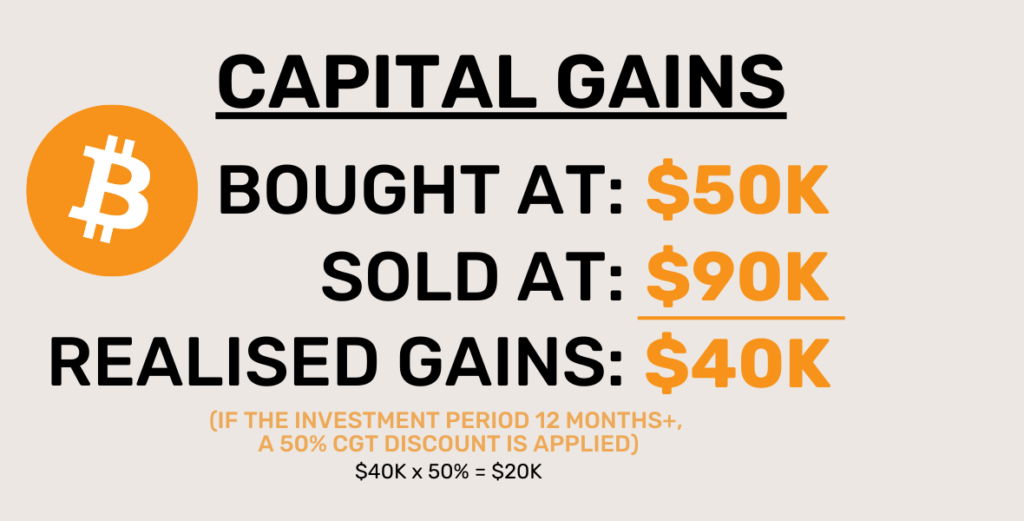

EG: Bought one Bitcoin at $50K. Price rises to $90K per one Bitcoin. You sell your entire one Bitcoin, resulting in a $40k realised Capital Gain (Profit). That $40k is Taxable.

- A capital loss occurs when your sale price is less than your cost base.

EG: Bought one Bitcoin at $100K. Price falls to $75K per one Bitcoin. You sell your entire one Bitcoin, resulting in a $25k realised Capital Loss (Net Loss). That $25k is a tax reducing event (Deferred tax benefits towards future CGT).

As at the time of writing this resource (October 2025), the Australian Tax Office (ATO) treats crypto as an asset, not a currency, meaning every transaction that disposes of crypto can create a taxable event.

The Key to Managing Crypto Tax: Strategic Realisation

Understanding when to realise a loss or a gain is critical. In a volatile market, you can use these movements to your advantage.

Let’s look at the example:

You buy 1 BTC at $100,000.

BTC falls to $50,000.

You sell 1 BTC for $50,000, creating a capital loss of $50,000.

You instantly buy back 1 BTC for $50,000.

Now your tax record shows:

- A $50,000 realised capital loss.

- No taxable gain on the repurchase (since it’s a new acquisition).

This capital loss can be offset for a number of years, remaining a useful tax tool for future CGT minimisation.

If BTC later rises to $120,000 and you sell:

- You’ll have a capital gain of $70,000 ($120,000 – $50,000).

- But you can offset that gain with the $50,000 loss you previously realised.

Effectively, you only pay CGT on the net $20,000 gain, not the full $70,000.

Compounding as a tax tool, CGT in Australia is also decided by the duration of which you hold your untouched assets. If you hold your purchased Bitcoin for less than a 12 month period, your entire profits are subject to CGT. However, if you purchased Bitcoin over 12 months ago, your profits would qualify for a 50% CGT discount, essentially halving the taxable profits.

Lets play out this scenario of a corporate employee who invests on the side:

Purchase & Sale Details

- Purchase price (cost base): $100,000

- Sale price (capital proceeds): $150,000

- Capital gain (before discount): $150,000 – $100,000 = $50,000

Holding Period

The Bitcoin investment was held for 1.5 years (18 months).

As that is longer than 12 months, the investor qualifies for the 50% CGT discount (for individuals and trusts).

Apply the 50% CGT Discount

- Discounted capital gain: $50,000 × 50% = $25,000

So, the taxable capital gain is now $25,000

Tax Payable Depends on Your Income Bracket

The discounted gain ($25,000) is added to the investor’s taxable income for the year and taxed at their marginal income tax rate.

For 2025/26, the Australian individual tax brackets (excluding 2% Medicare levy) are as follows:

Taxable Income

Tax Rate

0 – $18,200

Nil

$18,201 – $45,000

16c for each $1 over $18,200

$45,001 – $135,000

$4,288 plus 30c for each $1 over $45,000

$135,001 – $190,000

$31,288 plus 37c for each $1 over $135,000

$190,001 and over

$51,638 plus 45c for each $1 over $190,000

The Key to Managing Crypto Tax: Strategic Realisation

Here’s how you can maximise tax benefits legally and effectively:

Offset current-year gains:

If you made gains earlier in the year (e.g., from selling ETH, stocks, or property), realise strategic losses before June 30 to offset them.

Carry forward losses:

If you have no gains this year, you can carry capital losses forward indefinitely to reduce future taxable gains.

Long-term holding discount:

If you hold crypto for 12 months or more before selling, individuals can get a 50% CGT discount on gains. This doesn’t apply to companies.

Keep clean records:

The ATO requires detailed records for every trade, including:

- Dates of acquisition and disposal

- Cost base and sale proceeds

- Transaction fees

- Purpose of the transaction (investment, personal use, etc.)

Use crypto tax software or spreadsheets to maintain accuracy.

(COMING SOON | Shepley Capital Investment Tax Calculator)

Example Scenarios of CGT

Here are a few bonus scenarios to help you understand the concept of CGT:

Scenario 1 – Tax-Loss Harvesting Mid-Year:

You bought 2 ETH at $5,000 each ($10,000 total).

ETH drops to $3,000 each ($6,000 total).

You sell both for $6,000 and immediately buy back 2 ETH.

Result: $4,000 realised capital loss.

You can use that to offset other capital gains that year.

Scenario 2 – Long-Term Investor:

You bought 1 BTC at $40,000 in 2021.

You sell at $80,000 in 2024 after 3 years.

Your gain is $40,000, but with the 50% CGT discount, you only pay tax on $20,000.

Scenario 3 – Portfolio Rebalancing:

You decide to exit a poorly performing altcoin and rebalance into BTC.

You sell the altcoin at a loss, realise a deductible capital loss, and reinvest in a more stable asset.

Final Notes for CGT Regulations in Australia

- Crypto-to-crypto trades are taxable events in Australia. Swapping ETH for BTC still triggers CGT.

- Using crypto to buy goods or services also triggers a disposal.

- You cannot offset capital losses against ordinary income (like wages). Only against capital gains.

- Losses from theft or scams may also be claimable if properly documented.