Acquisitions and Indicators: A Market Primed for Global Injection | Capital Nexus - By Shepley Capital

Welcome to the latest edition of Capital Nexus – Shepley Capital’s crypto newsletter.

Whilst this week hasn’t looked as mighty in the charts, behind the scenes has painted a very different picture that investors should be excited for…

As we speak, the U.S government has hosted another pro-crypto summit where leaders in the Cryptocurrency space have met with government officials to fine-tune the regulations of this globally expanding space. Whilst the outcome of this summit is yet to be made public, investors should rest easy knowing that the digital finance space has a bright future ahead.

Ripple Prime: The Next Big Bridge Between Traditional Finance and Crypto

Earlier this week, Ripple acquired global prime brokerage firm Hidden Road in a $1.25 billion deal. The acquisition transforms Ripple from a cross-border payments provider into a full-stack institutional finance player, now operating under the name Ripple Prime.

Ripple Prime is the evolution of Ripple’s mission to modernise global finance. With the acquisition of Hidden Road, Ripple now controls a multi-asset prime brokerage that clears and settles up to $3 trillion annually across FX, derivatives, fixed income, and digital assets. This gives Ripple something few crypto companies have ever achieved; direct institutional access. Ripple Prime can now service hedge funds, banks, and asset managers, offering them execution, clearing, and financing through one unified platform, all with blockchain-level efficiency.

Hidden Road already actively worked with more than 300 institutional clients. So this latest acquisition allows Ripple to integrate those pre-existing relationships into their rapidly advancing ecosystem, Ripple Prime where they’re quickly becoming a credible gateway between Wall Street and Web3. It’s expected that Ripple will be introducing those institutions to their native infrastructure, the XRPL Ledger. This kind of competitive move within the crypto landscape gives Ripple (and XRP holders) the advantage in market capitalisation, whilst also providing traditional players comfort, confidence, & compliance to enter the blockchain landscape at scale.

Ripple has now evolved from a single-stream payments business into a multi-revenue financial technology platform. With Ripple Prime, they can tap into lending, financing, derivatives, and brokerage fees sectors that carry much higher margins and deeper client retention. From a high-level view of this acquisition, & those previously acquired; Ripple now owns the rails, the liquidity, and the financial instruments riding on them.

Whilst at this moment the Ripple ecosystem is leading the competition, it’s expected that other businesses will aim to compete on a similar level as soon as they can. That means expect further announcements of massive acquisitions in the near future by your favourite top performing crypto projects. For now, XRP holders should accept this much awaited news as a good sign of what’s to come for the project, and for the crypto industry.

The Next Bitcoin Cycle: Why The Stock-to-Flow Model Says the Real Rally Hasn’t Even Started

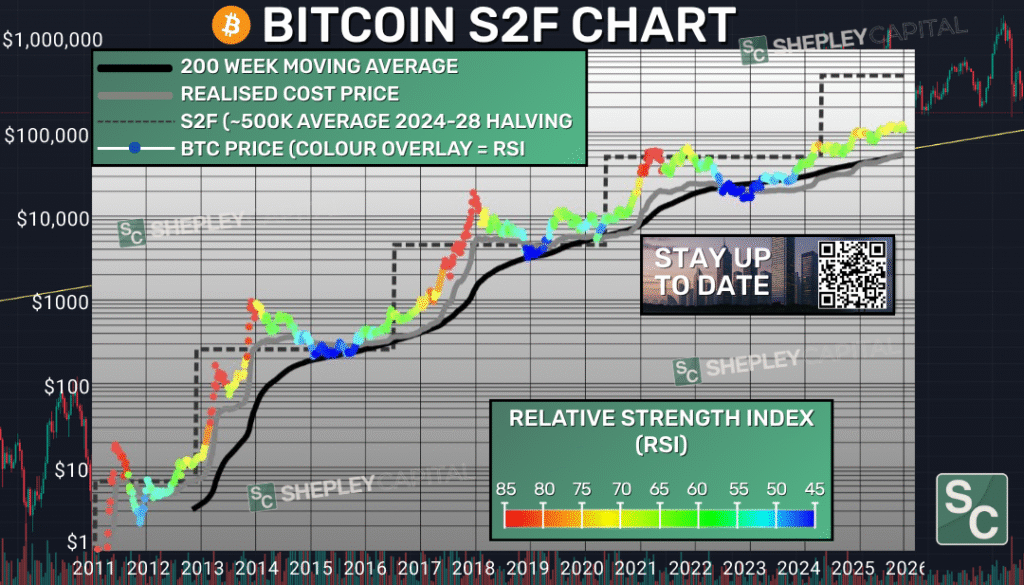

For the first time since Bitcoin’s creation, the Stock-to-Flow (S2F) model suggests we haven’t even entered the true uptrend of this cycle. Despite the increased market noise this cycle, every major indicator that historically aligns with previous rallies; MSVR Z-Score, RSI, and long-term moving averages, all point to one thing: Bitcoin hasn’t run yet.

The Stock to Flow model projects an average target of roughly $500,000 for the 2024–2028 halving cycle, yet BTC still trades near its realised cost base.

Every past cycle has followed a similar pattern:

– Post-halving accumulation (quiet phase).

– Momentum ignition (liquidity returns).

– Parabolic expansion (media, retail, speculation).

– Correction and reset.

And yet… we’re barely past stage one.

All signs are pointing toward a shift in cycle structure.

So here’s what I believe we’ll see heading into 2026…We’re moving past the classic 4-year Bitcoin cycle. Global adoption is too deep for 80% liquidation events and full-scale bear markets to repeat. From governments adding BTC to reserves, to institutions offering spot ETFs, to retailers accepting it as payment.. the market now has too many anchored holders to collapse in the same way. Bitcoin isn’t just a speculative asset anymore. It’s becoming an asset class with deep liquidity, strong custody options, and growing macro integration.

What we’re entering instead is a phase of sustained upward growth followed with stabilising BTC volatility. And for long-term investors, that’s exactly what you want.

The market is maturing.

The Stock-to-Flow model isn’t a perfect science.. but historically, it’s been an incredibly accurate macro compass for Bitcoin’s long-term trajectory. All indicators point to one clear message: the uptrend hasn’t even started.

Free Crypto Education for the Everyday Investor

We’ve previously broadcasted that our goal is to build a library of 10,000+ unique crypto resources tailored towards helping the everyday person succeed on their crypto journey. So far we’re 0.0013% of the way there, but who’s counting!

If you haven’t yet checked out our suite of Free Resources, here’s your Free Access Link.

We have an absolutely MASSIVE vision for this Cryptocurrency resource library, creating Australia’s largest go-to resource hub that Universities, Companies, & Individual investors can all go to learn about all things Crypto, Blockchain, Web 3, & Digital Finance.

Our only ask is that if you find any value in any one of these resources, it would be extremely valuable to us if you could leave us a 5-star review here. It genuinely will help us as we start to push Cryptocurrency education across Australia & Internationally!

See you next volume.

~ Chris Shepley

Founder of Shepley Capital